All Categories

Featured

Table of Contents

- – What type of insurance policies work best with...

- – How do I qualify for Privatized Banking System?

- – What resources do I need to succeed with Infi...

- – What resources do I need to succeed with Infi...

- – How does Generational Wealth With Infinite B...

- – Generational Wealth With Infinite Banking

- – How long does it take to see returns from Po...

The idea behind unlimited banking is to use this cash worth as a source of funding for numerous functions, such as investments or personal costs, while still making compound rate of interest on the cash value. The idea of infinite banking was first suggested and popularised by Nelson Nash, a financial advisor and author of the book "Becoming Your Own Banker".

The policyholder obtains against the money worth of the plan, and the insurance provider bills interest on the car loan. The rate of interest price is typically less than what a financial institution would certainly charge. The insurance holder can utilize the lent funds for numerous functions, such as investing in realty or beginning a service.

It is important to keep in mind that the policyholder has to not just pay the home loan on the investment residential or commercial property however likewise the passion on the policy financing. The interest settlements are made to the insurance coverage agent, not to oneself, although the policyholder might obtain dividends as a mutual insurance provider's shareholder

This stability can be interesting those who choose a traditional technique to their investments. Infinite banking provides insurance policy holders with a source of liquidity with policy financings. This indicates that also if you have borrowed against the cash value of your policy, the cash money worth remains to expand, supplying adaptability and accessibility to funds when required.

What type of insurance policies work best with Self-banking System?

The survivor benefit can be utilized to cover funeral prices, impressive financial obligations, and other costs that the family may sustain. Furthermore, the death benefit can be spent to give lasting financial safety for the insurance policy holder's household. While there are prospective advantages to boundless financial, it's necessary to think about the disadvantages as well: One of the key objections of unlimited financial is the high costs associated with whole-life insurance coverage.

Additionally, the costs and compensations can eat right into the cash money worth, lowering the general returns. When making use of boundless financial, the policyholder's investment choices are restricted to the funds available within the policy. While this can supply security, it might additionally restrict the potential for greater returns that might be achieved with various other investment cars.

How do I qualify for Privatized Banking System?

Take into consideration the case where you bought one such policy and performed a detailed analysis of its efficiency. After that, after 15 years into the policy, you would certainly have discovered that your policy would certainly have deserved $42,000. If you had merely saved and invested that cash rather, you can have had even more than $200,000.

To totally assess the practicality of limitless banking, it's necessary to recognize the charges and fees connected with whole life insurance policy policies. These charges can vary depending on the insurer and the certain policy. Life insurance loans. Costs cost fee: This is a percent of the costs quantity that is subtracted as a cost

What resources do I need to succeed with Infinite Banking For Retirement?

Per device charge: This charge is based on the fatality benefit amount and can vary depending upon the policy. Expense of insurance coverage: This is the expense of the called for life insurance coverage connected with the policy. When computing the possible returns of a boundless financial strategy, it's vital to element in these charges and fees to identify the true worth of the money worth development.

, decide for term insurance, which provides insurance coverage for a certain period at a reduced price. By doing so, you can allot the saved costs in the direction of investments that provide greater returns and better adaptability.

What resources do I need to succeed with Infinite Banking For Financial Freedom?

Pension: Adding to pension such as IRAs or 401(k)s can supply tax advantages and long-lasting growth possibilities. It's important to check out different choices and talk to a monetary advisor to identify which strategy aligns best with your monetary goals and run the risk of resistance. Since you have an extensive understanding of limitless financial, it's time to evaluate whether it's the ideal technique for you.

At the very same time, term life insurance policy does not supply any cash money worth, implying that you will not get anything if you outlast the plan. Additionally, term life insurance policy is not permanent, suggesting that it will certainly expire after a certain amount of time. Infinite banking can be a great idea for individuals that are trying to find a long-lasting financial investment strategy and who are willing to make considerable capital expense.

How does Generational Wealth With Infinite Banking compare to traditional investment strategies?

This website gives life insurance policy details and quotes. Each price revealed is a quote based on info offered by the service provider. No portion of might be copied, released or dispersed in any kind of fashion for any type of objective without previous created authorization of the proprietor.

Consider this for a minute if you could somehow recuperate all the passion you are currently paying (or will pay) to a loan provider, exactly how would certainly that improve your wealth producing potential? That includes charge card, auto loan, trainee financings, business loans, and also home mortgages. The average American pays $0.34 of every earned dollar as a rate of interest expenditure.

Generational Wealth With Infinite Banking

Envision having actually that rate of interest come back to in a tax-favorable account control - Infinite Banking for financial freedom. What possibilities could you benefit from in your life with even half of that cash money back? The fundamental concept behind the Infinite Banking Concept, or IBC, is for people to take more control over the funding and banking functions in their day-to-day lives

IBC is a technique where individuals can essentially do both. Just how is this possible? By having your buck do greater than one work. Today, when you invest $1, it does one point for you. It gets gas. Or it acquires food. Maybe it pays a costs. Maybe it goes in the direction of a vacation or huge purchase.

How long does it take to see returns from Policy Loans?

It can do absolutely nothing else for you. But what happens if there was a method that shows individuals just how they can have their $1 do than one job merely by relocating it through a possession that they manage? And what if this approach was easily accessible to the day-to-day individual? This is the essence of the Infinite Financial Idea, originally championed by Nelson Nash in his publication Becoming Your Own Lender (Cash value leveraging).

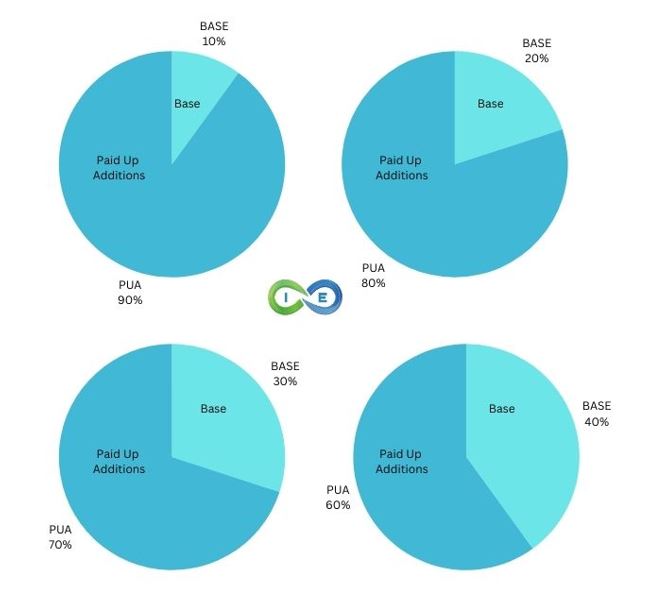

In his publication he shows that by producing your very own exclusive "financial system" with a specifically developed life insurance policy agreement, and running your dollars via this system, you can considerably enhance your monetary circumstance. At its core, the principle is as easy as that. Creating your IBC system can be performed in a selection of innovative ways without altering your capital.

Table of Contents

- – What type of insurance policies work best with...

- – How do I qualify for Privatized Banking System?

- – What resources do I need to succeed with Infi...

- – What resources do I need to succeed with Infi...

- – How does Generational Wealth With Infinite B...

- – Generational Wealth With Infinite Banking

- – How long does it take to see returns from Po...

Latest Posts

Infinite Bank Statement

What are the most successful uses of Wealth Management With Infinite Banking?

How do I leverage Infinite Banking In Life Insurance to grow my wealth?

More

Latest Posts

Infinite Bank Statement

What are the most successful uses of Wealth Management With Infinite Banking?

How do I leverage Infinite Banking In Life Insurance to grow my wealth?